social security tax calculator

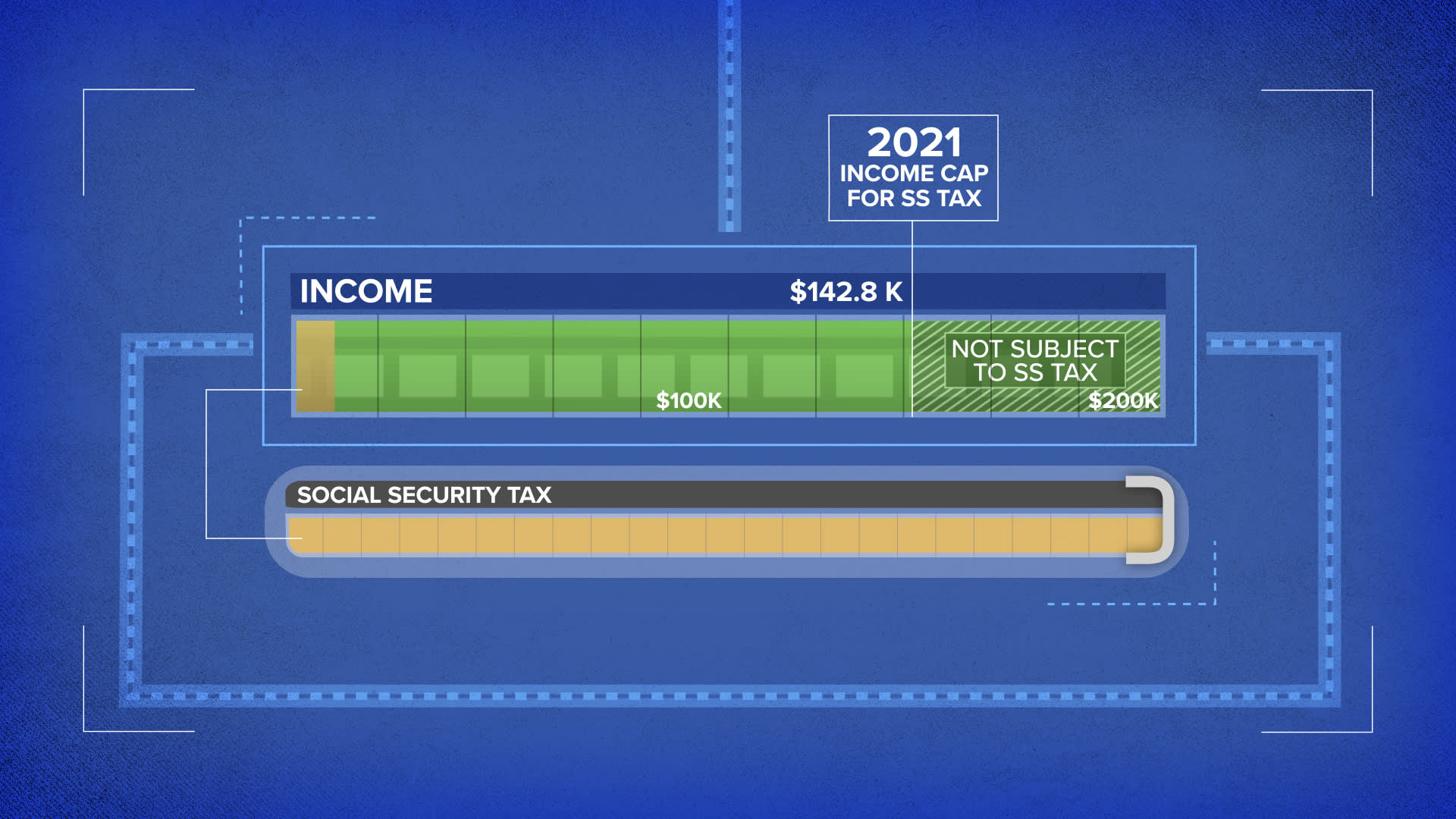

Yes there is a limit to how much you can receive in Social Security benefits. Social Security Taxes are based on employee wages.

Social Security Tax Cap 2021 Here S How Much You Will Pay

The rate consists of two parts.

. Before you use this. Heres how the maximum amount of money you could get breaks down monthly in 2022. The self-employment tax rate is 153.

The September 2022 Consumer. An individual who receives 198241050 net salary after taxes is paid 350000000 salary per year after deducting State Tax Federal Tax Medicare and Social Security. 2 days agoWith the bout of inflation hitting American wallets over the past year the Social Security cost-of-living adjustment could be huge for 2023.

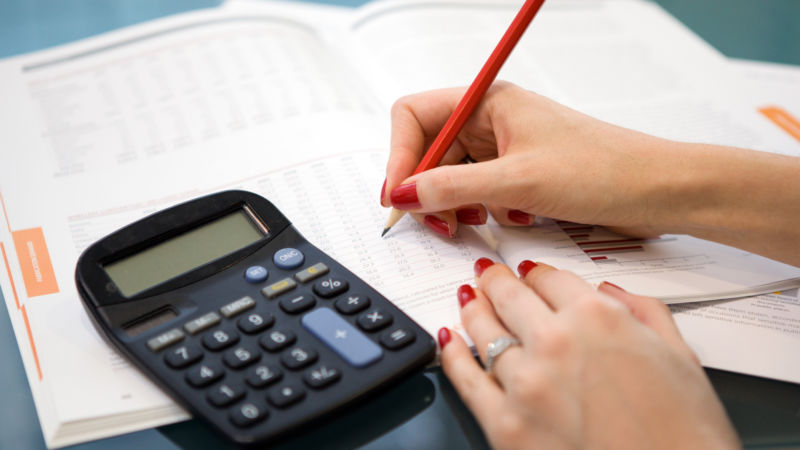

The tool has features specially tailored to the unique needs of retirees receiving. While they are all useful there currently isnt a way to help determine the ideal financially speaking age at which. Social Security Tax and Withholding Calculator.

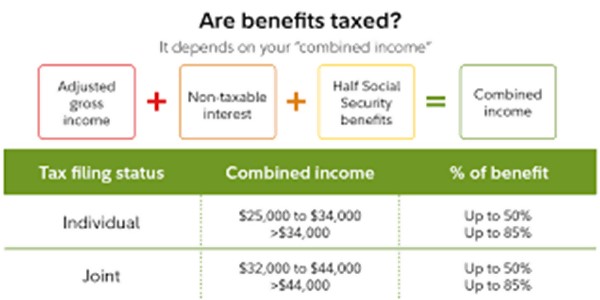

Did you know that up to 85 of your Social Security Benefits may be subject to income tax. If SS benefit exceeds 34K then taxable portion is 85 of your SS benefits. Social Security taxable benefit calculator.

As your total income goes up youll pay federal income tax on a portion of the benefits while the rest of your. Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity. Get the most precise estimate of your retirement disability and survivors benefits.

As your total income goes up youll pay federal income tax on a portion of the benefits while the rest of your. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Collecting Social Security at full retirement.

For each age we calculate. If this is the case you may want to consider repositioning some of your other income to minimize. Must be downloaded and installed on your computer.

For the purposes of taxation your combined income is defined as the total of your adjusted gross. Enter your expected earnings for 2022. Lets look at how to.

Depending on your income and filing status up to 85 of your Social Security benefit can be taxable. Social Security benefits are 100 tax-free when your income is low. For 2022 its 4194month for those who retire at age 70.

Social Security Taxable Benefits Calculator. Social Security website provides calculators for various purposes. For modest and low incomes none of your.

SS benefit is between 232K 44K then taxable portion is 50 of your SS benefits. So benefit estimates made by the Quick Calculator are rough. If youre single a combined income between 25000 and 34000.

Give you an estimate of how much youll have to pay in taxes on your monthly benefits. For incomes of over 34000 up to 85 of your retirement benefits may be taxed. The maximum Social Security benefit changes each year.

Enter total annual Social Security SS benefit amount. Use this calculator to estimate how much of your Social Security benefit is subject to income taxes. So if you have 10000 of Social Security.

Collecting Social Security at age 62. There are two components of social security. The AGI included in Column 1 is already reduced by the Social Security amount half of the benefit in Column 3 must be added back in.

No what were saying is youre going to pay your tax rate whatever that happens to be on up to 85 of the money that you receive. Box 5 of any SSA-1099 and RRB-1099 Enter taxable income. Social Security benefits are 100 tax-free when your income is low.

Thats what this taxable Social Security benefits calculator is designed to do. The mobile-friendly Tax Withholding Estimator replaces the Withholding Calculator. The estimate includes WEP reduction.

Social Security Just Emailed Us About Their Website Upgrade Here S What They Didn T Say

Tax Liability What It Is And How To Calculate It Bench Accounting

Tax Calculator Including Social Security Medicare Ppt Powerpoint Presentation Outline Images Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Social Security What Tax Rate Will I Pay On My Benefits The Motley Fool

How To Compute Net Pay Social Security Federal State Medical Insurance Medicare Finance Personal Youtube

Resource Taxable Social Security Calculator

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Last Week In Payroll Repaying Deferred Social Security Taxes

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Is Social Security Taxable Complete Guide Tips Inside

A Closer Look At Social Security Taxation Jim Saulnier Cfp Jim Saulnier Cfp

Tax Calculator Estimate Your Income Tax For 2022 Free

Solved Calculate Social Security Taxes Medicare Taxes And Chegg Com

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)

Estimating Taxes In Retirement

International Social Security Calculator Global Tax Gateway

/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)